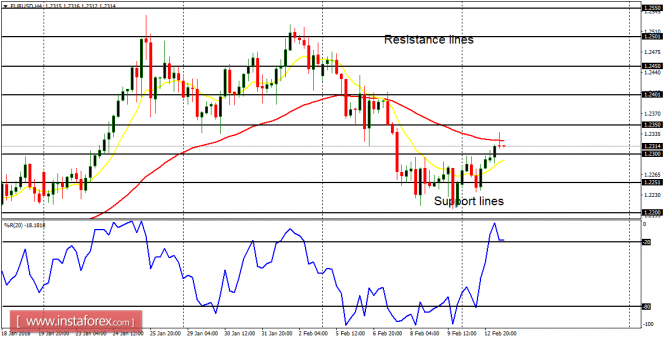

EUR/USD: The EUR/USD has continued the bullish journey which started last week. At this time, it can still be called a bullish movement in the context of a downtrend, which would end up threatening the recent bullish bias (once the resistance line at 1.2400 has been breached to the upside). A movement to the downside would help restore the bearishness in the market.

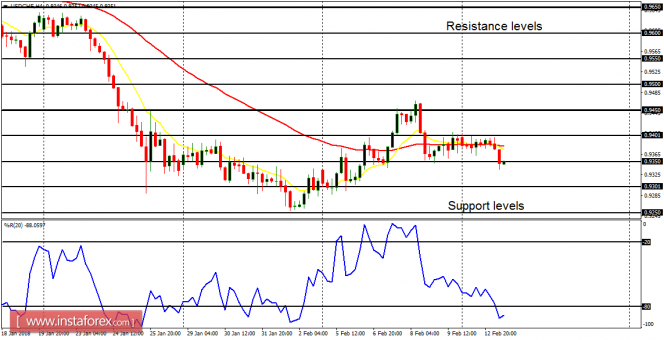

USD/CHF: This pair moved sideways on Monday, and then started moving southwards today. This has resulted in a short-term "sell" signal, which could help to propel the price towards the support levels at 0.9300 and 0.9250. The market is currently below the resistance level at 0.9350.

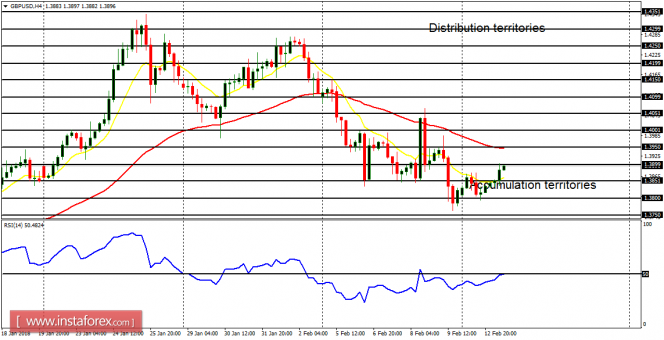

GBP/USD: What is happening on the Cable is merely a rally attempt in the context of a downtrend. Should the market come down from here, the recent bearishness in the market would be saved; otherwise, a new bullish bias would form (especially when the distribution territories at 1.4000 and 1.4050 are breached to the upside).

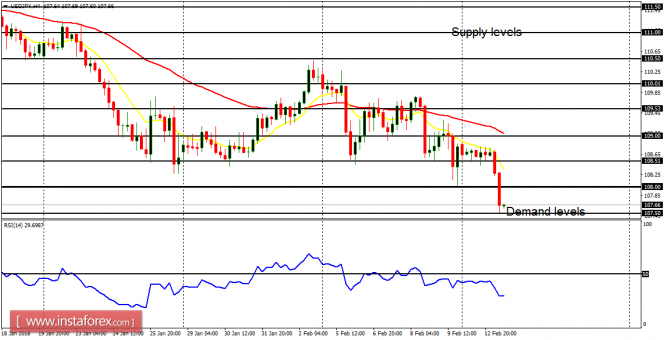

USD/JPY: According to the expectation for this week, the USD/JPY has been going southwards. Price has shed 120 pips this week, following the brief consolidation that was seen on Monday. The demand level at 107.50 has been tested, and it would be breached to the downside, as another demand level at 107.00 is being targeted.

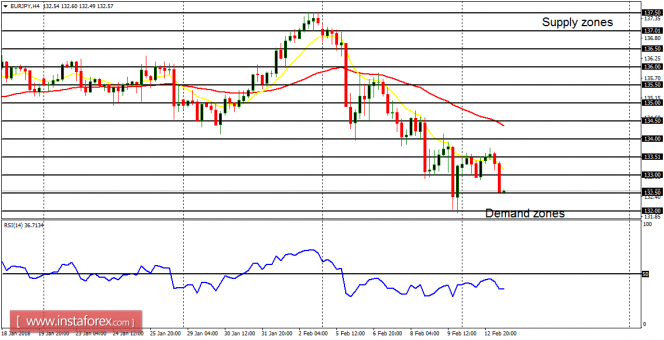

EUR/JPY: This cross was indecisive on February 12, but it has resumed the bearish movement, which started last week. There is a Bearish Confirmation Pattern in the market, which signals a further plunge. The next targets are the demand zones at 132.50, 132.00, and 131.50. Strong volatility is a possibility this week.

No comments:

Post a Comment