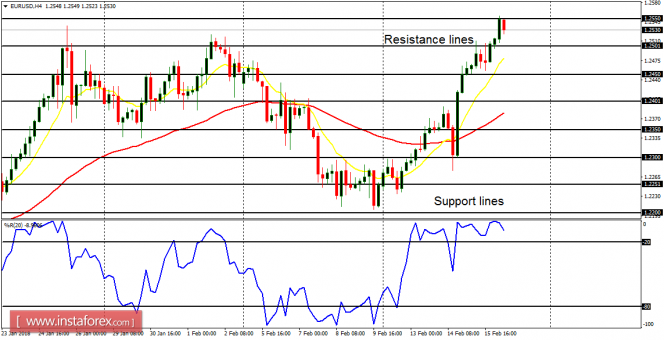

EUR/USD: The EUR/USD pair has gained about 300 pips this week... Having tested the resistance line at 1.2550. There has been a minor bearish retracement after the resistance line was tested, but price would go upwards again to test the resistance line and breach it to the upside. This would make the market target another resistance line at 1.3050.

USD/CHF: The USD/CHF pair has continued its slow and gradual bearish movement, having shed about 195 pips this week. Price is now below the resistance level at 0.9350, going towards the support level at 0.9200 (which has already been tested). As long as the EUR/USD pair is strong, USD/CHF would be going bearish.

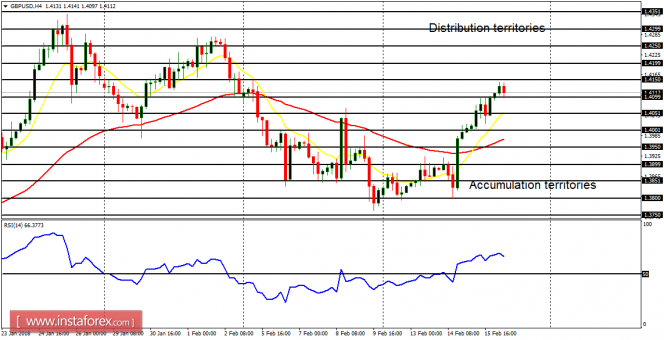

GBP/USD: There is a bullish outlook on this currency trading instrument, as it has gained about 330 pips this week. Further northwards journey can help the market reach the distribution territory at 1.4100 (which has been previously tested), 1.4150 and 1.4200. The current bearish correction is shallow and it is expected to be temporary.

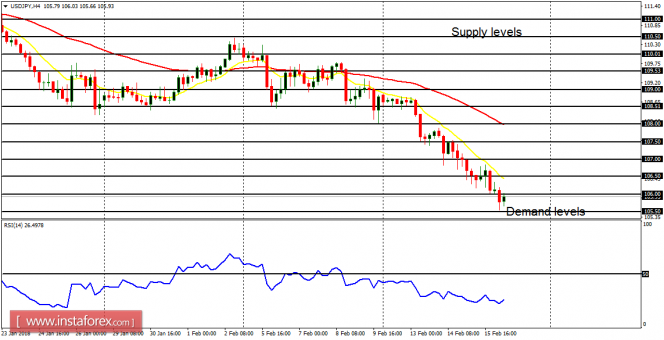

USD/JPY: The USD/JPY pair has been engaged in a smooth, clean bearish movement for this week. The EMA 11 is above the EMA 56, and the RSI period 14 is now above the level 50. Since there is a Bearish Confirmation Pattern in the market, it is expected that price should be able to go below the demand level at 105.50, and remain below it.

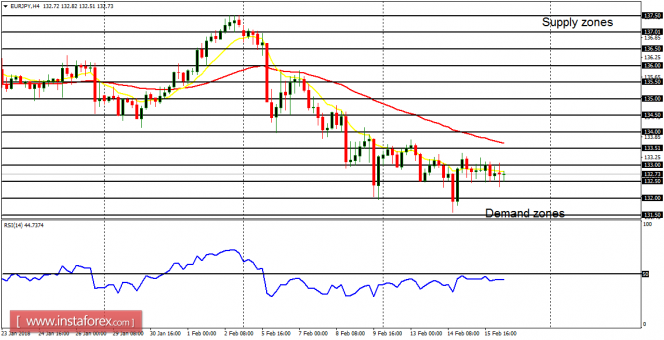

EUR/JPY: The situation in this market remains the same. Price is consolidating to the downside in the context of a downtrend. There are possibilities that the demand zones at 132.00 and 131.50 would be tested. There is also a possibility that a rally could occur before the end of today, or early next week.

No comments:

Post a Comment