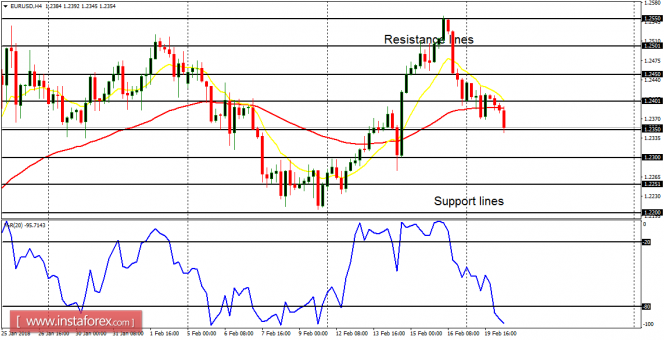

EUR/USD: This currency pair has been going downwards since Monday, shedding about 90 pips in the context of an uptrend. The price is now below the resistance line at 1.2350, going towards the support line at 1.2300. A movement below another support line at 1.2250 would result in a short-term bearish bias.

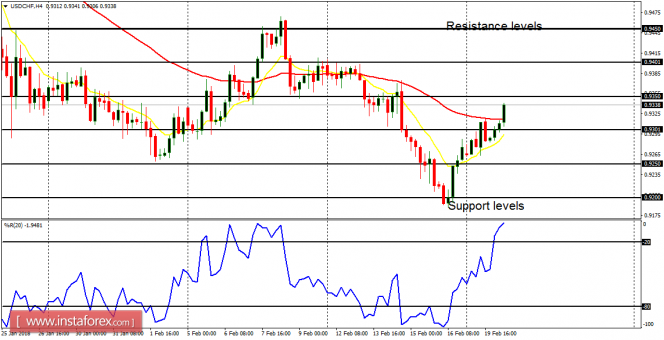

USD/CHF: This pair has been going upwards since yesterday, gaining about 93 pips in the context of a downtrend. The price is now above the support level at 0.9300, going towards resistance level at 0.9350. A movement above the resistance level at 0.9400 would result in a short-term bullish bias.

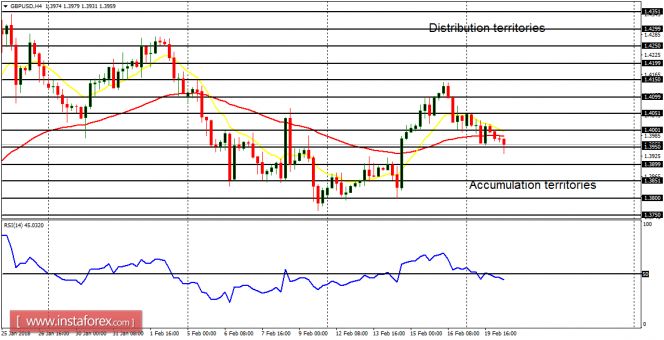

GBP/USD: This pair did not do anything significant on Monday, and it is doing nothing now. The market is neutral in the short term and bullish in the long term. However, a movement below the accumulation territory at 1.3850 would result in a bearish outlook; while an upwards movement from here would save the recent bullish bias.

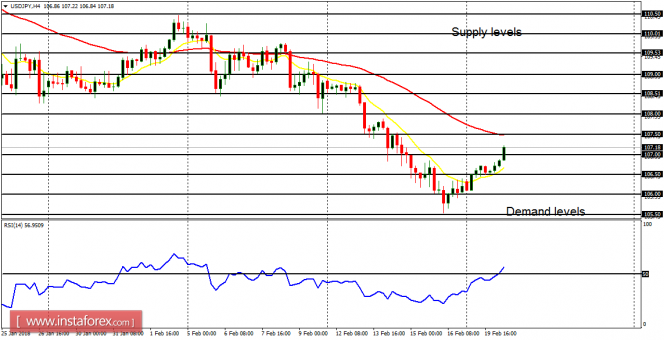

USD/JPY: This USD/JPY pair has been going upwards in the context of a downtrend. About 110 has been gained – and the bias could turn bullish when the supply level at 108.00 is breached to the upside. The demand levels are at 106.50 and 106.00, which may also be tested, which could reveal bears' power.

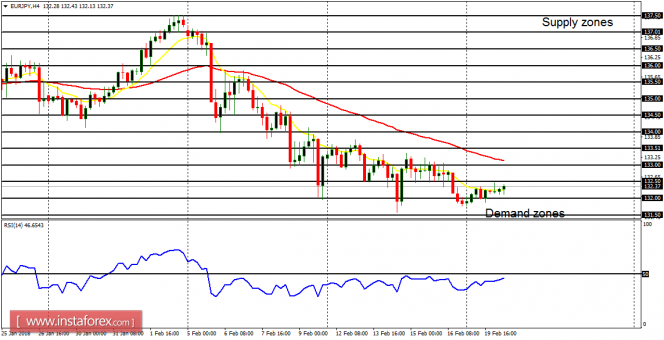

EUR/JPY: This cross pair has been moving sideways in the short term. The bias remains bearish, and thus, when a breakout occurs (which would eventually happen), it would most probably favor bears. The demand zones at 132.00, 131.50 and 131.00 could be tested before the end of this week.

No comments:

Post a Comment