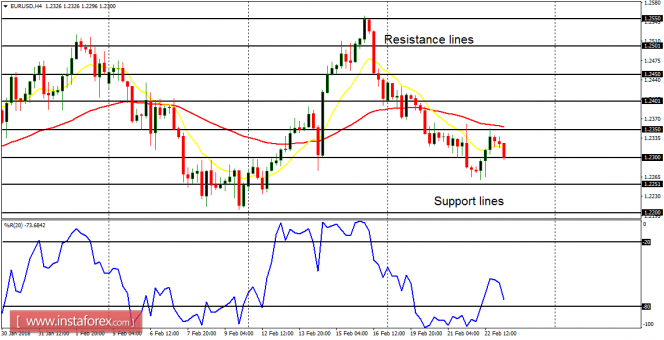

EUR/USD: A bearish signal has been generated for the EUR/USD pair, which has been going downwards since last Friday. There is a Bearish Confirmation Pattern in the market, which shows that it is not advisable to place long trades for now. While there may be temporary rallies, the market is bound to go further downwards.

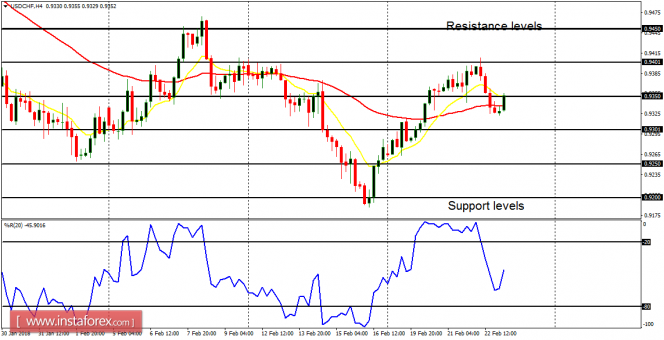

USD/CHF: A bullish signal has been generated on the USD/CHF, which has been upwards since last Friday. The EMA 11 is above the EMA 56, and the Williams' % Range period 20 is not too far from the overbought region. While there may be temporary dips (just as it has happened recently), the market is bound to go further upwards.

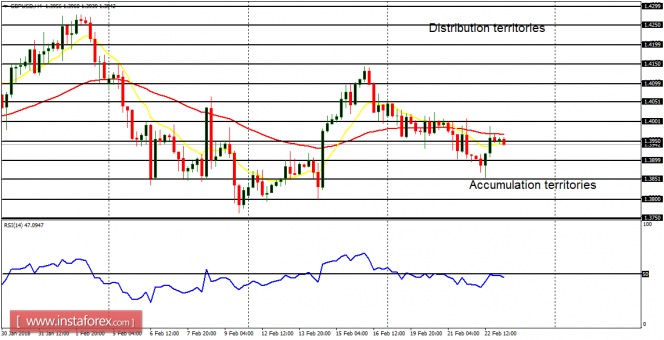

GBP/USD: The GBP/USD is bearish, although the market has not gone significantly lower this week. An upside movement of about 200 pips would result in a bullish bias; whereas a movement towards the accumulation territories at 1.3900, 1.3850 and 1.3800, will result in more emphasis on the bearishness of the market.

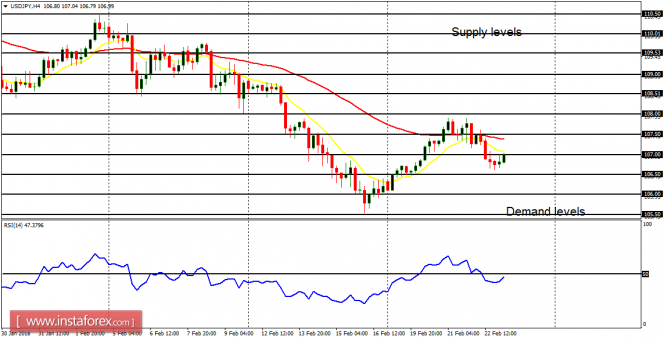

USD/JPY: From Monday to Wednesday, the price moved upwards by 170 pips (from the demand level at 106.00 and to just above the demand level at 107.50). That become a threat to the existing bearishness in the market, but bears were able to save the day as the price was pushed lower on Thursday, thus saving the week in favor of the bearish bias. The market can go lower.

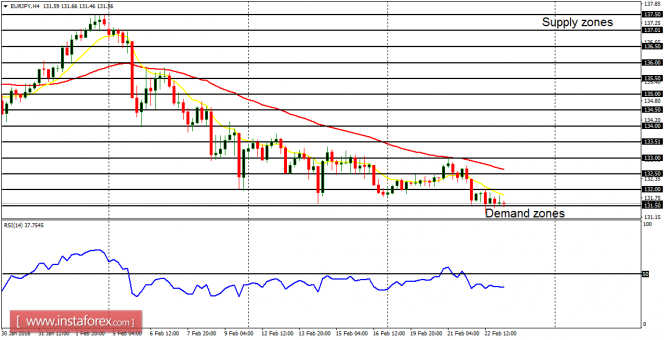

EUR/JPY: The EUR/JPY pair has been engaged in a slow and steady downwards movement since February 5, having lost about 560 pips since then. There is a strong Bearish Confirmation Pattern in the market and the price is poised to go lower and lower, reaching the demand zones at 131.50 and 131.00.

No comments:

Post a Comment