After days of struggle at the edge of the 84.50 price area, AUD/JPY has dropped impulsively lower recently, which is expected to move much lower in the coming days. Recently, AUD has been struggling with mixed economic reports, while JPY has the background of positive economic results. Recently, AUD Construction Work Done is expected to show a decrease of 19.4% from the previous 16.6%, which was a significant tumble in Housing Development. Additionally, the latest Monetary Policy Meeting did not provide any positive hint for the further gain on the AUD side, whereas the RBA is expecting higher inflation in the future, which might have no immediate impact on the growth of AUD. On the JPY side, the Trade Balance report was published with a significant increase to 0.37T from the previous figure of 0.09T, which was anticipated to be at 0.14T. The positive Trade Balance supported JPY against AUD, whereas further gains are expected in the coming days. Tomorrow's JPY National CPI report is forecasted to show to a decline to 0.8% from the previous value of 0.9% and SPPI is expected to be unchanged at 0.8%. As of the current scenario, the upcoming economic reports are projected to be quite neutral whereas any better result may lead to further impulsive gain on the JPY side in the coming days.

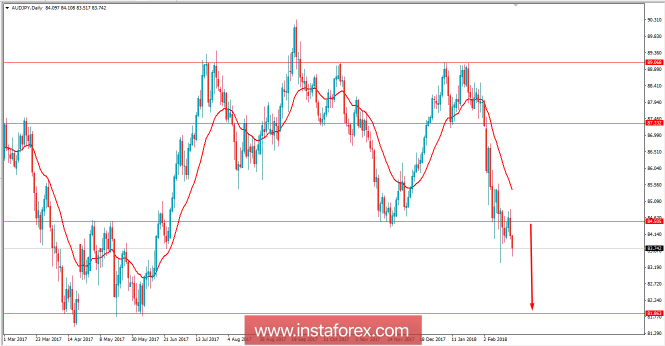

Now let us look at the technical view. The price is currently residing below the 84.50 price area from where the price is expected to go lower towards the 82.00 support area in the coming days. The price is expected to correct along the way, but the bears are currently quite strong, which might lead to further bearish pressure in the coming days. As the price remains below 84.50, the bearish bias is expected to continue further.

No comments:

Post a Comment