EUR/USD has been quite bearish after the recent positive USD Employment Change report published on Friday. The USD Non-Farm Employment Change report was published with a significant increase to 200k from the previous figure of 160k which was expected to be at 181k, Average Hourly Earnings report was published at 0.3% which was better than an expectation of 0.2% and Unemployment Rate report was unchanged at 4.1%. Whereas EUR has been struggling with the mixed economic reports recently. Today EUR Spanish Services PMI report was published with an increase to 56.9 from the previous figure of 54.6 which was expected to be at 55.2, Italian Services PMI report was published with an increase to 57.7 from the previous figure of 55.4 which was expected to be at 56.1, French Final Services PMI was slightly decreased to 59.2 which was expected to be unchanged at 59.3, German Final Services PMI was slightly increased to 57.3 which was expected to be unchanged at 57.0 and EUR Final Services PMI increased to 58.0 which was expected to be unchanged at 57.6. Moreover, today EUR Sentix Investor Confidence report was published with decrease to 31.9 from the previous figure of 32.9 which was expected to increase to 33.2, Retail Sales report was published as expected at -1.1% which decreased from the previous positive value of 2.0% and ECB President Draghi spoke quite neutral about the upcoming policies to be implemented which are expected to have no recent effect on the market. On the other hand, today USD ISM Non-Manufacturing PMI report was published with an increase to 59.9 from the previous figure of 55.9 which was expected to be at 56.5 and Final Services PMI report was published unchanged as expected at 53.3. The positive economic reports on the USD helped to gain more bearish momentum in the market which is expected to push much lower in the coming days. As of the current scenario, USD is expected to pressurize EUR for a short period of time before the bullish trend continues to push the price higher above 1.25 in the coming days.

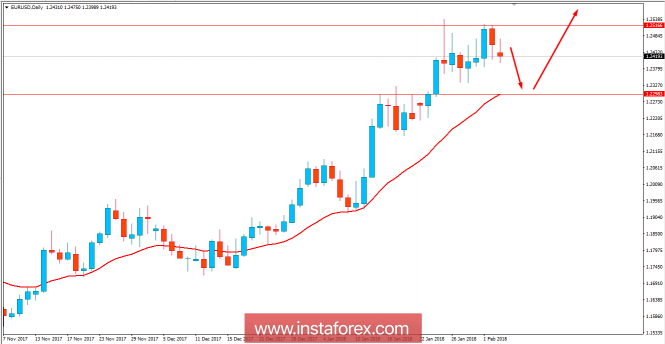

Now let us look at the technical view. The price has already rejected the bulls in a daily candle today where USD strengthened after the positive economic reports published today. Currently, the price is expected to proceed lower towards 1.23 support area where the dynamic level of 20 EMA is also currently residing and from where the price is expected to bounce higher with the target towards 1.28 in the coming days. As the price remains above 1.23 with a daily close, the bullish bias is expected to continue further.

No comments:

Post a Comment