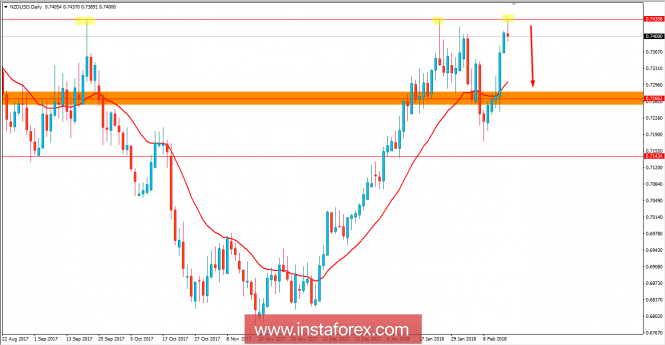

NZD/USD has been quite impulsive with the bullish gains recently which has lead the price to retest and reject off the 0.7450 resistance area. NZD has been quite positive with the economic reports this week while USD was struggling with the mixed economic reports. Recently, Inflation Expectation report was published in New Zealand with a slight increase to 2.1% from the previous value of 2.0% and FPI report showed a positive change to 1.2% from the previous negative value of -0.8%. The positive inflation report helped NZD to gain impulsive momentum which resulted in impulsive domination over USD this week. Today, New Zealand Business Manufacturing Index report was published with an increase to 55.6 from the previous figure of 51.1. However, NZD could not sustain the gain well enough, as a result NZD lost some grounds against USD after a non-volatile intraday bullish trend in place. On the other hand, today US Building Permits report is yet to be published which is expected to show a slight decrease to 1.29M from the previous figure of 1.30M, Housing Starts is expected to increase to 1.23M from the previous figure of 1.19M, Import Prices is expected to increase to 0.6% from the previous value of 0.1%, and Prelim UOM Consumer Sentiment report is expected to have a slight decrease to 95.4 from the previous figure of 95.7. To sum up, any positive economic report on the USD side which are yet to be published, will be able to push the price much lower against NZD that might lead to steady bearish pressure in the coming days.

Now let us look at the technical chart. The price is expected to proceed lower towards the support area 0.7250 as today the price rejected off the important event level of 0.7450 resistance area with a daily close. The trend has been quite volatile recently, so the pair is expected to trade under bearish pressure in the coming days. As the price remains below 0.7450, the bearish bias is expected to continue further.

No comments:

Post a Comment