Disappointing statistics on U.K. retail sales for January (+ 0.1% with a forecast of + 0.5% m / m) and profit taking on short positions on the U.S. dollar put an insurmountable barrier to the pound "bulls" to the north. Looking at how the profitability growth of the 10-year treasury bonds, the chances of the Federal Reserve's four monetary restrictions for the year 2018 has increased and the U.S. macroeconomic statistics has improved that makes it difficult to understand why the USD index fell. Undoubtedly, it is playing out the factor of growing fears about the future recession, but is it too early to talk about it?

Sterling, on the other hand, still can not find a balance between the "hawkish" position of the Bank of England and political risks. By the end of the week on February 23rd, the EU summit and the meeting between Angela Merkel and Theresa May in Berlin are planned, which can shed light on the issue on the severity of the Brexit. The leaders of the European Union will decide what to do with the budget of € 1 trillion after the divorce from Britain. Germany is not averse to increasing costs, but the Netherlands, Finland, and Denmark would prefer to reduce them. As for the Prime Minister, there are rumors on the market that she wants to maintain relations with the European Union in certain areas (financial services, agriculture) and exit without significant losses in others.

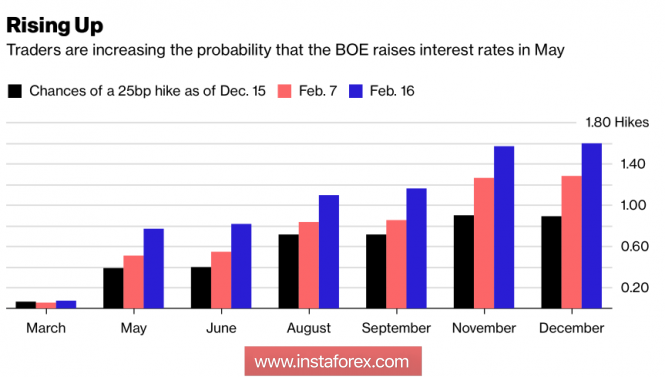

The main support for the pound is provided by the hawkish rhetoric of the Bank of England, which is allowed to grow to 78%. And yet, the indicator was at the level of 38% in January. Supporters of sterling wrote off the weakness of retail sales for the post-Christmas syndrome. Indeed, the main problems came from the food products.

The dynamics of the probability of raising the repo rate.

Source: Bloomberg.

By issuing moderately optimistic assessments of the Albion economy in the future, the BoE proceeds from the assumption that the acceleration of the average wage against the background of the slowdown in inflation will lead to an increase in the real incomes of the population, expand its purchasing power and eventually accelerate GDP. In this respect, the release of data on the labor market in Britain is able to test this theory for strength. Contrary to the expectations of the regulator, CPI does not want to go far from the psychologically important mark of 3 percent. It remains to look at the average salary. According to forecasts of Bloomberg experts, the results will grow by 2.5% y / y in December. The best evidence will open the way of the GBP / USD pair northward.

An important role in the fate of the pair will be the behavior of the U.S. dollar. Currently, many investors are switching from the Fed's monetary policy to a dual budget deficit and current account, arguing that the deteriorating financial situation puts the wheel on the capital inflow to the United States and leads to the sales of the U.S. currency.

Technically, a successful assault on $ 1,415 is required to continue the pound rally. On the contrary, a breakthrough of support near $ 1.38 will strengthen the risks of correction development in the direction of $ 1.36.

GBP / USD pair, daily chart

No comments:

Post a Comment