AUD/USD has been volatile and corrective for a few days now. Currently, some bearish pressure is being observed, pushing the price below 0.77 area. Despite positive economic report today, AUD failed to gain momentum over USD whereas the market is currently traded with the bearish bias. Today, Australia's AIG Service Index report was published with an increase to 56.9 from the previous figure of 54.0 and Trade Balance report was published better than expectation of decrease to 0.68B but resulted to 0.83B which previously was at 0.95B. On the USD side, the economic reports today did not live up to the expectation. However, ahead of the upcoming high impact economic reports like NFP, Average Hourly Earnings, and Unemployment Rate reports the market seems quite biased on USD side. Today, US Unemployment Claims report showed a significant increase to 242k from the previous figure of 218k which was expected to be at 225k, Trade Balance report showed a greater deficit to -57.6B from the previous deficit of -56.7B which was expected to be at -56.9B and Natural Gas Storage report was published as expected at -29B decreasing the deficit of -69B. As for the current scenario, apart from the Natural Gas Storage reports, the US failed to provide upbeat economic reports to push its gains, whereas certain increase in Unemployment Claims indicates a higher probability of worse outcome of the upcoming macroeconomic reports tomorrow. If the US manages to provide better economic reports as the market sentiment suggests, further bearish pressure is expected, whereas USD is expected to dominate AUD further in the coming days.

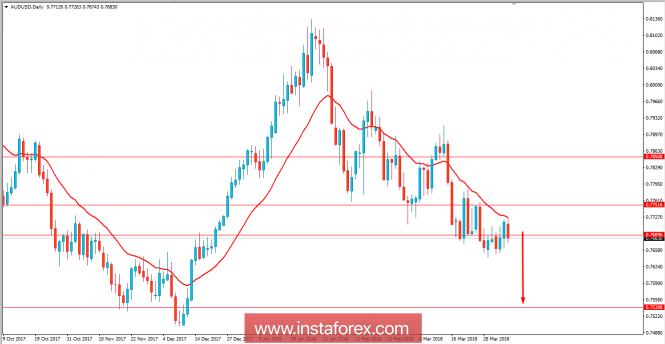

Now let us look at the technical view. The price is currently residing below 0.77 price area with confluence to the dynamic level of 20 EMA as resistance where it is expected to proceed much lower if we see a daily close below 0.77 price area. As the price remains below 0.7750 area, the bearish bias is expected to continue further.

No comments:

Post a Comment