AUD/USD has been quite corrective and volatile after breaking above the 0.7750 price area with a daily close recently. Today was an important day for AUD as Employment reports was published which turned out to be a let-down for the currency to sustain its bullish pressure. Today, AUD Employment Change report was published with an increase to 4.9k from previous figure of -6.3k which failed to meet the expectation of 20.3k and Unemployment Rate was published unchanged, as expected, at 5.5%. Moreover, NAB Quarterly Business Confidence report was published unchanged at 7. AUD, having certain economic reports, resulted to more struggle to continue its impulsive bullish pressure. On the other hand, the market sentiment has been quite against USD as of the recent rate hikes and worse economic reports results. This week, USD managed to provide slight better than expected economic reports like Building Permits with an increase to 1.35M from the previous figure of 1.32M and Housing Starts with an increase to 1.32M from the previous figure of 1.30M. As of the current scenario, USD is expected to gain momentum over AUD which is expected to struggle to sustain the bullish pressure due to worse Employment reports, published today. Though the pair is still expected to quite volatile and corrective in nature while the bears pushing the price lower.

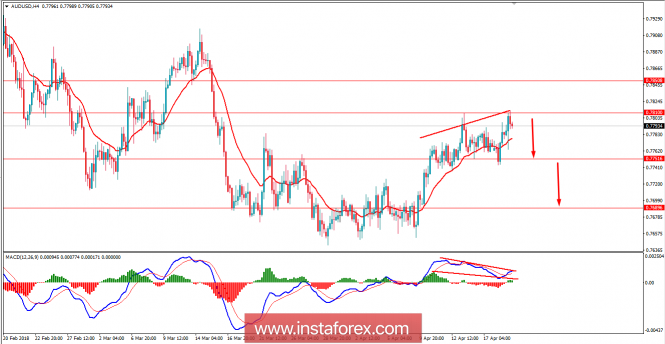

Now let us look at the technical view. The price has formed a Bearish Regular Divergence along the way which has recently showed bearish impulsive pressure and expected to push the price lower towards the 0.7700-50 support area in the coming days. As the price remains below 0.78 with a daily close, further bearish pressure is expected in this pair.

No comments:

Post a Comment