EUR/JPY has been in a correctional phase with high volatility, trading between 129.50 and 132.00. The pair is following a downward bias as JPY has been outperforming EUR recently with better economic data. The price is below the 132.00 resistance area. This week, JPY started with downbeat economic reports like Tankan Manufacturing Index decreasing to 24 from the previous figure of 26 and Tankan Non-Manufacturing Index also decreasing to 23 from the previous figure of 25. Despite soft economic reports, JPY managed to sustain the bearish bias in the pair. Besides, the pair is expected to proceed lower in the coming days. Today, Japan released a Monetary Base report which showed a decrease to 9.1% from the previous value of 9.4% which was expected to increase to 9.6%. Today, the weak economic report capped the growth of JPY but it was not as impulsive as a totally counter move to the overall bearish bias. On the other hand, today German Retail Sales report was published with a decrease to -0.7% from the previous negative value of -0.3% which was expected to increase to 0.7%. As for the current scenario, EUR failed to provide a push needed to create the impulsive bullish pressure in the pair. Thus, JPY is expected to dominate further in the short term.

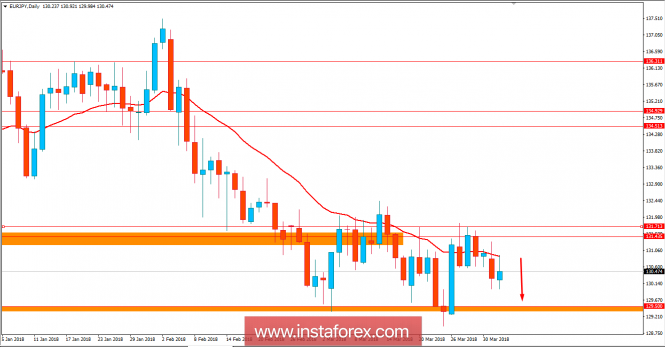

Now let us look at the technical view. The price is currently holding below 132.00 price area with a bearish squeeze with confluence to the dynamic level of 20 EMA. The price is currently expected to proceed lower towards 129.50 later this week from where a break below or bounce with a daily close will lead to upcoming trading decision in this pair. As the price remains below 132.00 price area, further bearish pressure is expected.

No comments:

Post a Comment