EUR/USD has been quite impulsive with the bearish gains recently after bouncing off the 1.24 price area with a daily close. After certain consolidations previously, the positive economic reports of USD helped the currency to gain momentum over EUR, ahead of the upcoming EUR Minimum Bid Rate report to be published this week. Though the rate is expected to be unchanged at 0.0% but along with ECB Press Conference the market is expected to be quite volatile before the weekly close. Today, EUR French Flash Manufacturing PMI report was published with a decrease to 53.4 as expected from the previous figure of 53.7, French Flash Services PMI was published with an increase to 57.4 from the previous figure of 56.9, which was expected to decrease to 56.6, German Flash Manufacturing PMI report was published better than expected, but with a slight decrease to 58.1 from the previous figure of 58.2, which was expected to decrease to 57.6, and German Flash Services PMI report was published with a slight increase to 54.1, which was expected to be unchanged at 53.9. Moreover, EUR Flash Manufacturing PMI report was published with a decrease to 56.0, which was expected to be unchanged at 56.6, and Flash Services PMI report was published with a slight increase to 55.0 from the previous figure of 54.9, which was expected to decrease to 54.8. On the other hand, ahead of the upcoming CB Consumer Confidence and Advance GDP report to be published this week, which is expected to inject volatility in the market, today, USD Flash Manufacturing PMI report is going to be published, which is expected to have a slight decrease to 55.2 from the previous figure of 55.6, Flash Services PMI is expected to increase to 54.3 from the previous figure of 54.0, and Existing Home Sales report is expected to have a slight increase to 5.55M from the previous figure of 5.54M. As of the current scenario, EUR has been quite mixed with the economic reports, which did not help the currency to gain momentum against the USD impulsive bearish pressure today. Ahead of the upcoming economic reports to be published on the USD side, further bearish pressure is expected in this pair for the coming days of the week, whereas certain volatility is expected on the ECB Press Conference and EURO Minimum Bid Rate report publish period.

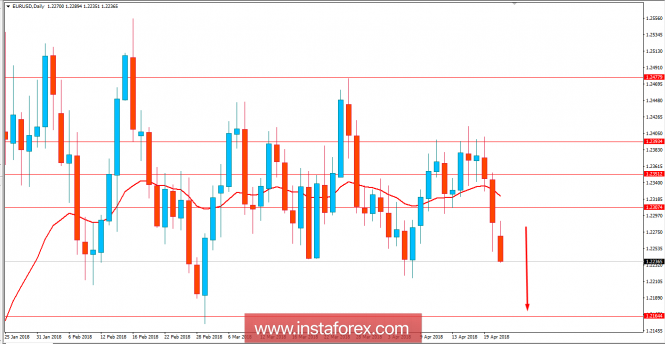

Now let us look at the technical view. The price is currently impulsive with the bearish gains below the 1.23 price area which is expected to proceed towards the 1.2160 support area in the coming days. There was a gap in the market today, during the open which was retested before proceeding lower with the impulsive pressure. As the price remains below the 1.2350 area with a daily close, further bearish pressure is expected to continue.

No comments:

Post a Comment