USD/CAD has been quite impulsive with the bearish gains which lead the price to reside below 1.28 price area recently. Ahead of the upcoming high impact economic reports on CAD and USD this week, the price action is currently quite indecisive whereas CAD is expected to have an upper hand over USD as of the current scenario. Today CAD Trade Balance report is going to be published which is expected to show more deficit to -2.1B from the previous figure of -1.9B. Moreover, tomorrow CAD Employment Change report is going to be published which is expected to increase to 18.8k from the previous figure of 15.4k and Unemployment Rate is expected to be unchanged at 5.8%. On the other hand, USD has been struggling with the economic reports recently which failed to provide the required push for the currency to counter the impulsive bearish momentum in the pair. Today USD Unemployment Claims report is going to be published which is expected to increase to 225k from the previous figure of 215k and Trade Balance report is expected to have a slightly greater deficit at -56.9B from the previous figure of -56.6B. Additionally, tomorrow Average Hourly Earnings report is going to be published which is expected to increase to 0.3% from the previous value of 0.1%, Non-Farm Employment Change is expected to decrease to 190k from the previous figure of 313k and Unemployment Rate is expected to decrease to 4.0% from the previous value of 4.1%. As of the current scenario, CAD is currently looking quite optimistic about the upcoming economic reports whereas USD is expected to struggle with mixed economic reports as per forecast. Positive economic report result on the CAD side is expected to provide the required push for the pair to push lower in the coming days whereas worse results will lead to corrections.

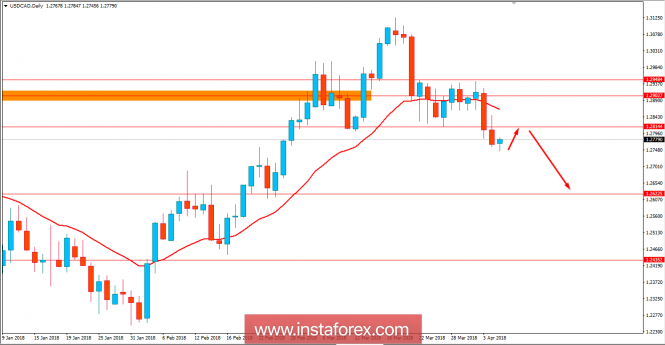

Now let us look at the technical view. The price is currently showing some bullish pressure which is expected to bounce off from the 1.2800-50 price area which will lead to further bearish momentum towards 1.26 price area. The dynamic level of 20 EMA has been violated recently with daily close which does explain the bearish bias in the current market scenario. As the price remains below 1.2850 price area, the bearish bias is expected to continue.

No comments:

Post a Comment