The dollar ended the week with a slight increase, which is natural before the weekend, but the long-term trend is still unclear. The blow to Syria did not lead to a significant reaction of the markets, the demand for safe haven assets practically did not increase, the markets did not see the threat of escalation.

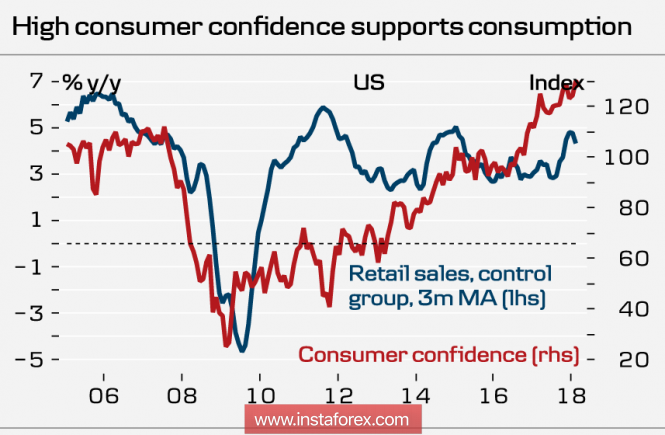

The preliminary value of the consumer confidence index from the University of Michigan in April was 97.8p, which is below 101.4p in March and below forecasts, but the overall trend continues to remain confidently high. The last spike in the index occurred during the period of Donald Trump's presidency and is connected with the tax reform, which contributes to the growth of consumption due to lower costs.

On Tuesday, April 16, data on retail sales in March will be published. Growth is expected amid high consumer activity. As reported by the Bank of America, spending on goods of everyday demand increased significantly in March, the result is not worse than expectations and will support the dollar.

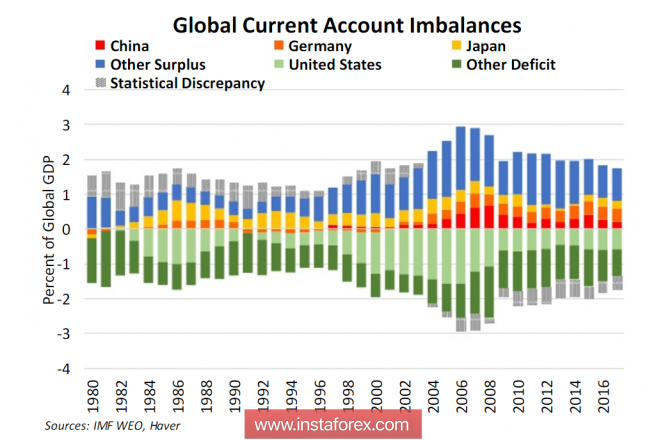

It was assumed that this week will be marked by the development of trade contradictions between the US and China. Despite the fact that both sides are not interested in escalating the dispute, the US, by some criteria, simply has no choice. The Ministry of Finance, analyzing capital flows, provides a graph of the state of the current account of the largest countries, from which it can be seen that the largest deficit is in the USA, and the surplus is in Germany, Japan and China. The growth of the current account deficit usually precedes the financial crisis, as it points to the tendency of borrowing growth when trying to maintain the current level of consumption, this was the case in 2000-2006, which led to a huge financial crisis.

Trump tries to prevent an unfolding of similar events, trying to rectify the trade imbalance. An increase in the Fed's rate will lead to the fact that the debt service will become the largest part of federal budget spending, and reducing the balance, to which the Fed has already started last fall, will put the government in front of the need to seek new buyers of public debt.

It is possible to break out of this trap by conducting several counter procedures simultaneously. First, it is necessary to achieve production growth directly in the United States in order to increase tax collection and reduce imports. Secondly, it is necessary to reduce the trade deficit by any means, which the Trump administration does by regulating the tariffs in its favor. And thirdly, it is necessary to maintain a high level of capital inflow through both the repatriation mechanism and foreign capital, which requires an appropriate foreign policy.

The policy of the Fed and the government, at first glance, contradict each other, but from the Trump administration we still have not heard a single word of protest against the tightening of monetary policy, and it makes the life of the government much more difficult. The head of the Federal Reserve Bank of Minneapolis Kashkari said on Friday that the problems of the Treasury and the level of public debt are not the problems of the Fed, and these criteria are not guided by the regulator when developing his monetary policy. The Fed will continue to adhere to the policy of normalization, which can lead to tightening of financial conditions and bring a new crisis closer, according to various estimates, it can be developed this year.

A report on industrial production in March will be published on Tuesday. The latest ISM and Markit data indicate that the growth momentum is maintained, so the final data may come out better than expected.

In general, the week will not be interesting from the point of view of macroeconomic releases, the focus will be primarily on foreign policy and negotiations with the main trading partners. The dollar index to growth is not seen and will trade within the established trading ranges in anticipation of new information.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment