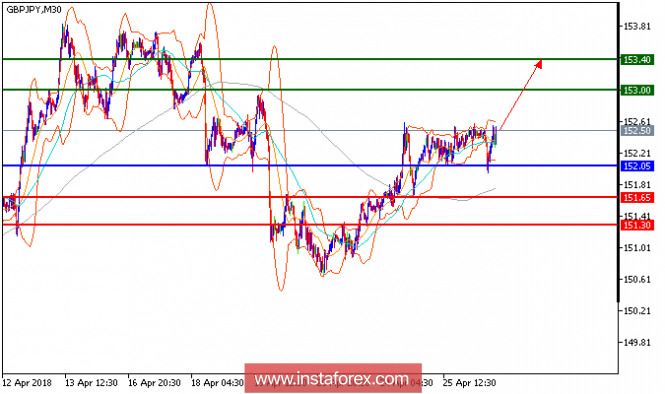

GBP/JPY is expected to trade with bullish outlook. The pair has pulled back on its horizontal support at 151.65, and is likely to post a new rebound. The relative strength index is also turning up, which should confirm a positive outlook. In addition, both the 20-period and 50-period moving averages are heading upward. Therefore, as long as 152.05 holds on the downside, look for a new rise to 153.00 and 153.40 in extension.

Fundamentally:

The British pound marked a day-low of US$1.3916, its lowest intraday level since March 19, before rebounding to close at US$1.3975, up 0.3% on the day and snapping a five-session losing streak. The currency was boosted by a revised 44 billion-pound bid by Japan's Takeda Pharmaceutical for London-listed drugmaker Shire.

Chart Explanation: The black line shows the pivot point. Currently, the price is above the pivot point which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines show the support levels, while the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 153.00, 153.40, and 154

Support levels: 151.65, 151.30, and 152.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment