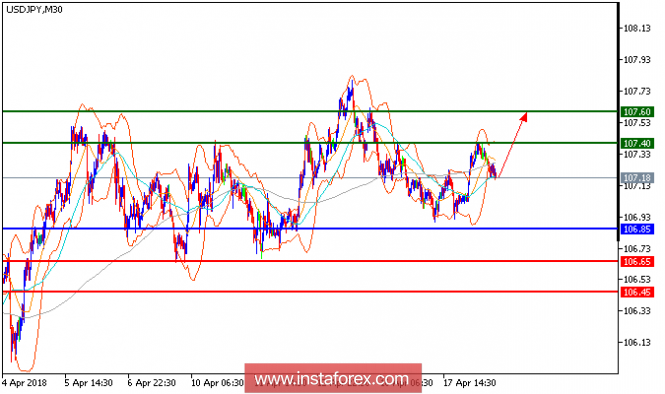

USD/JPY is expected to trade with a bullish outlook. the pair continues a rebound initiated at a low of 106.87 seen overnight (April 17). Currently, it has returned to levels above both the 20-period and 50-period moving averages. At the same time, the relative strength index has jumped into the 60s, indicating that upward momentum could help produce a new upleg for the pair. As long as the bullish bias is maintained, the pair is expected to revisit 106.85 on the upside (around the high of yesterday) before targeting 107.40.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 106.85, take profit at 107.40.

Resistance levels: 107.40, 107.60, and 107.90

Support levels: 106.65, 106.45, and 106.00.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment