The US dollar continues to grow strongly against the backdrop of fairly average macroeconomic data. Regional reports indicate a slowdown in manufacturing activity. The Federal Reserve Bank of Chicago reported on the decline in the index of business activity in April to 0.10p against 0.98p in February. The index of the Federal Reserve Bank of Richmond did go to negative territory to -3p against 15p in March.

Auctions for the placement of US debt securities are taking place against a background of a sharp drop in demand. The yields of 10-year US government bonds reached a maximum in 4 years for the first time since 2014, exceeding the 3% mark. This is a significant event for the financial markets and it indicates that the maintenance of the growing national debt for the US government is becoming increasingly expensive. Meanwhile, the placement of new loans is more problematic.

The yields of the two-year securities finally reached the level of 2008 which indicates problems with customers. US stock markets set a maximum in January, after which the rollback began. This means there is an excessive demand for financial assets in this market.

Thus, both the debt market and the stock are in the sale phase with buyers being cached. The financial flows are clearly not in favor of the dollar but in practice, we will observe exactly the opposite effect: the dollar is growing steadily against most of the competitors.

What's the matter? Who is the buyer of the American currency and how stable is this process?

This week, an impressive team of negotiators was sent to China, whose goal is to prevent a full-scale trade war between the countries. The delegation includes Treasury Secretary Steven Mnuchin, US Trade Representative Robert Lighthizer, and the director of the National Economic Council of the White House, Larry Kudlow.

It is likely that we see an attempt to implement the next scenario. As you know, China owes the US a debt of $ 1.2 trillion, being the largest creditor of the US government in the world. The trade war declared by Trump has provoked China's response, which partially restricted the access of American products to its market. However, if the US realizes the threat of limiting imports by another $ 100 billion, China will not be able to respond symmetrically. There is simply no suitable import from the US. Accordingly, China begins to limit investments in Treasury, which in the current conditions for the US government is equivalent to bankruptcy.

A representative delegation will most likely try to conclude a deal. Trade restrictions against China will not be introduced and China, in turn, will continue to buy into the US national debt. In the current conditions, the deal can be arranged by all parties. It is possible that we are seeing the purchase of US dollars in these seemingly unfavorable conditions with the most informed market participants who are preparing for the planned results of the deal. The influx of Chinese capital into the US debt market will cause a sharp drop in yields and a rise in the value of bonds, which will provoke strong demand for the dollar.

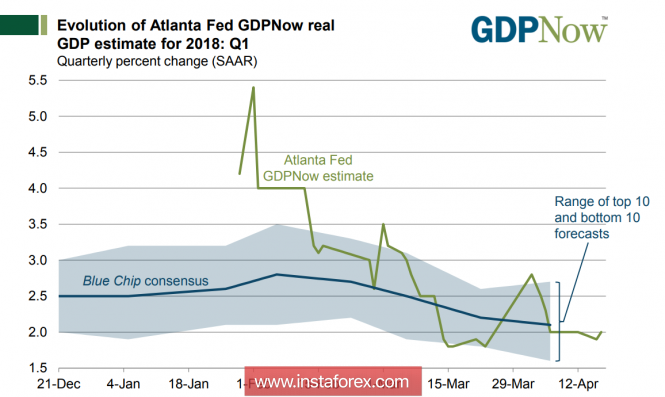

Thus, the growth of the dollar may be due to political rather than economic reasons. On Friday, preliminary data on US GDP in Q1 will be published. A slowdown is expected in Q4. The GDPNow model from the Federal Reserve Bank of Atlanta insists on a 2% growth.

At the same time, a significant decrease in the index of spending on personal consumption is expected. This is a key indicator of consumer demand, which determines, among other things, the level of tax collection. Trends indicate a deterioration, which will lead to a decrease in budget revenues and an increase in the deficit, as we discussed in detail in the previous review. These factors should put pressure on the dollar. However, as we see, it ignores macroeconomic factors, completely focusing on geopolitical factors.

The first results of the talks will be known on Saturday and therefore until the end of the week, the demand for the dollar will increase. Against the yen, the dollar will test the resistance level at 110.48. For the euro, it is the key support level of 1.2150 which will most likely not stand. Meanwhile, gold may fall below the level of 1320 per ounce.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment