FOMC meeting predictably ended with the retention rate at the current level. The stock markets reacted with a slight decrease. The yield of US Treasuries remained virtually unchanged. The text of the accompanying commentary did not contain any clues as to the future actions of the regulator. The markets took this result with some disappointment and the dollar fell slightly.

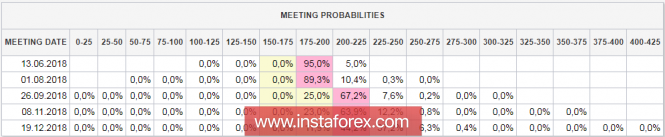

At the moment, the markets are fully confident that another rate increase will take place in June, and with a high probability, there'll be another one in September. Regarding the fourth increase, opinions are divided and it is the intrigue on this point that is the main factor since the three increases in this year have long been accounted for in quotations.

Today, the US-China trade talks start in Beijing and apparently, their result will determine the direction of the markets' movement. The US delegation's representatives are as follows: in addition to Treasury Minister Mnuchin and Minister of Commerce Ross, there's a sales representative in the rank of Minister Lighthizer, two presidential assistants, and the US ambassador to China. Despite the fact that the official agenda is to work out a new trade agreement, the underlying reason for the talks is the need to force China to finance the rapidly growing US budget deficit. Ross, in an interview with CNBC said before the trip that if the talks fail, the US can use the provisions of the trade law of 1962, allowing the president to apply measures "to ensure national security." Obviously, the issue is not acute. China is shying away from expanding purchases of US government bonds.

Recently, Trump held talks with Macron and Merkel and could not get the necessary result. Europe fiercely resists, as a change in trade conditions will directly affect the export potential of the eurozone and reduce the competitiveness of European companies in the global market. However, the United States also has no other way out. The US government's interest load is currently at 1.6% of GDP or 9.4% of federal revenues, and will only grow in the future. According to the forecast of the CBO, by 2022 payments for servicing the federal debt will increase to 16% of revenues and therefore, the financing of budget expenditures by traditional methods is hardly possible.

In fact, changing trading conditions is one of the necessary steps that will delay the onset of a technical default. The US has to increase its revenues either by any means necessary or by "pulling down" the growth of the national debt because only through additional borrowing will they be able to close the budget deficit and carry out social programs. It is impossible to increase tax revenues to the budget in the foreseeable future, and it is absolutely unacceptable to reduce social expenditures, since such actions will lead to a noticeable drop in the standard of living.

That's the only way. The pressure is on creditors to force them to continue financing the US economy. And here there is no division into allies or opponents, the pressure on Europe or Japan will be exactly the same as pressure on China.

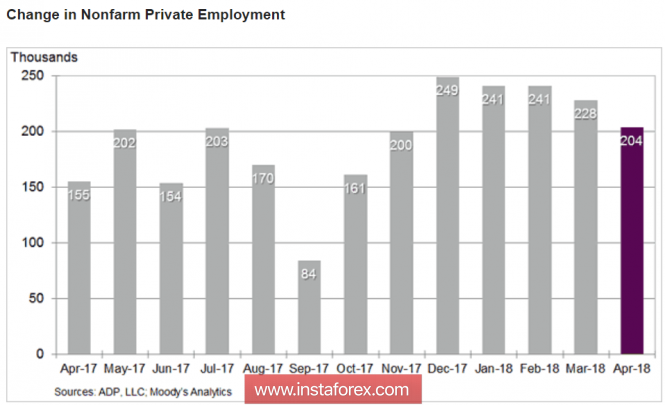

Against this background, the actual macroeconomic news fades into the background but you can not ignore them anyway. The ADP report on employment in the private sector came in line with expectations, which allows us to hope for optimistic results of tomorrow's labor market report.

In the foreground, data will not even stand for the total number of new jobs, since it is simply impossible to maintain this indicator at the level of the three-year maximum with the current unemployment rate. The focus will be on the level of pay, the main driver of inflation and consumer demand. It is forecasted that the hourly wage growth will be at 2.7%, as a month earlier, any deviation from this result can significantly affect the dollar rate.

For the combination of factors, there is no reason to expect a weakening of the dollar. Negotiations in China will be held from a position of strength. The demand for government bonds is growing, which indirectly indicates a growing interest in US assets. The dollar will finish the week with growth against most competitors.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment