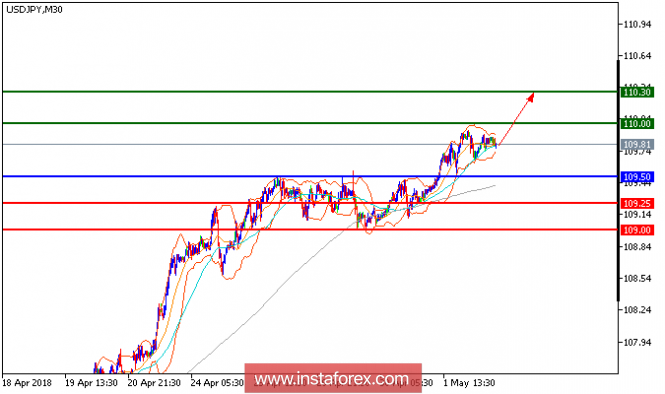

All our upward targets which we predicted in the previous analysis have been hit. USD/JPY is expected to trade in a higher range. The technical outlook of the pair is bullish as the prices have recorded a series of higher tops and higher bottoms since April 27. The upward momentum is further reinforced by both rising 20-period and 50-peirod moving averages. The relative strength index advocates for further upside. Hence, above 109.50, look for an advance with targets at 110.00 and 110.30 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 109.50, take profit at 110.00.

Resistance levels: 110.00, 110.30, and 110.75

Support levels: 109.25, 109.00, and 108.40.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment