GBPUSD has been quite indecisive today after breaking above 1.43 price area with an impulsive bullish momentum recently. The effect of certain bearish intervention in the non-volatile bullish trend is the cause of mixed economic reports published today. GBP has been the dominant currency in the pair since USD started its struggle due to the downbeat employment reports published recently. The recent rate hike without proper inflation in the economy was a big drawback as well. Today, the UK Average Cash Earning Index report was published unchanged at 2.8% which was expected to increase to 3.0%. Besides, Claimant Count Change showed a better than expected reading, decreasing from 15.1k to 11.6k which was expected to be at 13.3k and Unemployment Rate decreased to 4.2% which was expected to be unchanged at 4.3%. The mixed economic reports did not quite help GBP to sustain its bullish momentum in the market whereas USD took the chance to recover in the process. On the USD side, today Building Permits report is going to be published which is expected to increase to 1.33M from the previous figure of 1.30M, Housing Starts is also expected to increase to 1.27M from the previous figure of 1.24M, Capacity Utilization Rate is expected to have a slight decrease to 77.9% from the previous value of 78.1% and Industrial Production report is expected to decrease to 0.3% from the previous value of 1.1%. Moreover, today FOMC Members Williams and Quarles are going to speak about the interest rate and monetary policy. Their remarks are expected to be neutral in nature. As for the current scenario, if the US economic reports are better than expected or mixed, further bearish pressure is expected in this pair in the short term before GBP takes charge to continue its bullish trend in the coming days.

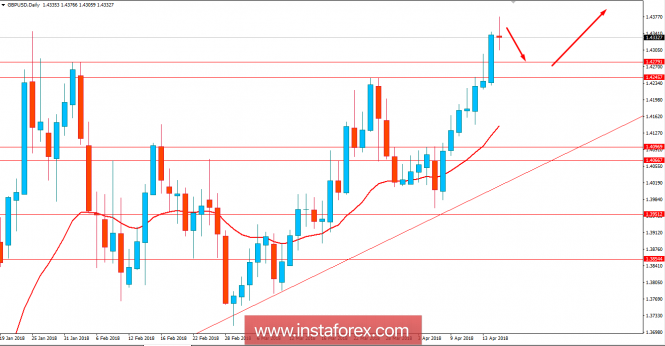

Now let us look at the technical view. The price is currently quite indecisive and has already showed good bullish rejection since the start of the day. The struggle between the sustainability of the gains is still quite indecisive but bears are expected to push the price towards 1.4250-1.4300 before price proceeds higher with a target towards 1.45 in the future. As the price remains above 1.40 with a daily close, the bullish bias is expected to continue further.

No comments:

Post a Comment