USD/CAD has been quite impulsive and as well as non-volatile recently which helped the bulls to gain consistent gains and sustain it pretty well. USD has been the dominant currency in most of the major currency pair whereas being impulsive with the gains against CAD is no different. Today US Core Durable Goods Orders report published today with a decrease to 0.0% from the previous value of 1.0% which was expected to be at 0.5%, USD managed to sustain the bullish pressure in the market today. Moreover, US Durable Goods Orders report was published better than expected but decrease to 2.6% from the previous value of 3.0% which was expected to decrease to 1.6%, Unemployment Claims had positive result of decrease to 209k from the previous figure of 233k which was expected to be at 230k, Goods Trade Balance report was published with less deficit at -68.0B from the previous figure of -75.9B which was expected to be at -74.8B and Prelim Wholesale Inventories had positive result of decrease to 0.5% from the previous value of 1.0% which was expected to be at 0.6%. On the CAD side, it has been struggling with the recent economic reports where the Employment reports were not that satisfactory and this week BOC Governor Poloz's speech was quite neutral with the upcoming developments of CAD which helped USD to gain more momentum in the process. As of the current scenario, USD is expected to extend its gains further in the coming days, whereas CAD might struggle to fight back until any positive high-impact economic report or event comes to the rescue in the future.

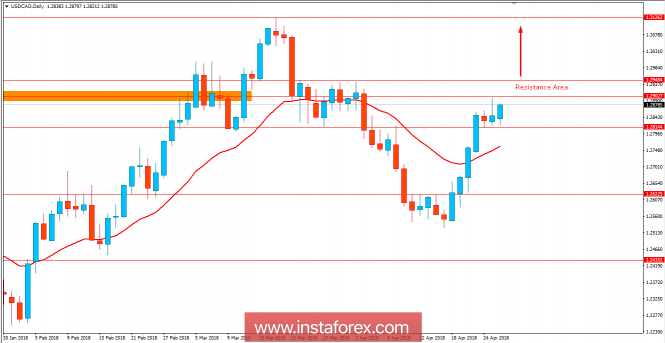

Now let us look at the technical view. The price is currently quite impulsive with the bullish pressure whereas yesterday's bullish rejection off the resistance area of 1.2900-50 shook up the market sentiment for a bit. As the price is residing below the resistance area of 1.2900-50, there are certain possibilities that bears can attack anytime soon. In this case, if the price manages to break above 1.2950, which is more likely as of the current market structure, the price is expected to push higher towards the 1.31 resistance area in the coming days. As the price remains above the 1.28 area, the bullish bias is expected to continue.

No comments:

Post a Comment