USD/CHF has been non-volatile and impulsive with the bullish gains recently after breaking above and retesting the 0.9450 area. USD has been quite positive with the economic reports recently which helped the currency to gain and sustain its bullish momentum against CHF. The Core Durable Goods Orders report was published today with a decrease to 0.0% from the previous value of 1.0% and versus the expected rise of 0.5%. Despite that, USD managed to maintain the bullish pressure in the market today. Along with the Core Durable Goods Orders report, the Durable Goods Orders report was published which showed a decrease to 2.6% from the previous value of 3.0% which was expected to decrease to 1.6%. The Unemployment Claims had positive result of decrease to 209k from the previous figure of 233k which was expected to be at 230k. Additionally, the Goods Trade Balance report was published with less deficit at -68.0B from the previous figure of -75.9B which was expected to be at -74.8B. Finally, the Prelim Wholesale Inventories had positive result of decrease to 0.5% from the previous value of 1.0% which was expected to be at 0.6%. On the other hand, this week the Swiss Trade Balance report was published with a significant decrease to 1.77B from the previous figure of 3.08B which was expected to increase to 3.23B. Moreover, the Credit Suisse Economic Expectation report was published with decrease to 7.2 from the previous figure of 16.7. As of the current scenario, CHF was held back against the USD momentum for the weak economic reports published recently. On the other hand, USD is currently quite stronger at its peak and expected to gain momentum in the coming days.

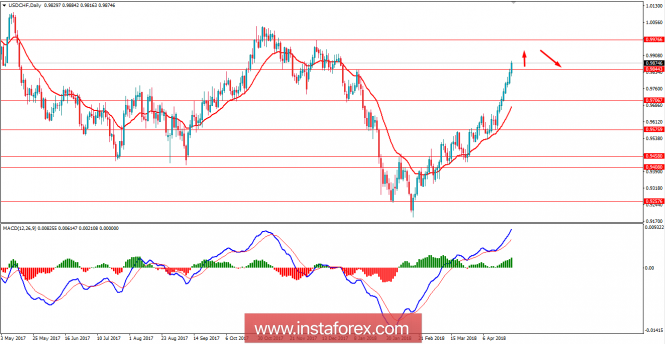

Now let us look at the techncal view. The price is currently residing above the price area of 0.9850 from where it is expected to push towards 0.9950-1.00 resistance area in the coming days. Currently Hidden Divergence is being build up in the intraday 4 hourly chart whereas the price is expected to push lower from the 0.9950-1.00 resistance area with certain strong momentum.

No comments:

Post a Comment