After the unsuccessful attempt to breakthrough the upper border of the medium-term trading range of $ 1300-1360 per ounce, the gold collapsed downwards on an unfavorable external background. The topic of the trade war in the context of rapid negotiations between Washington and Beijing no longer provides support for safe havens, while the shift in investors' interest in tightening monetary policy of the Federal Reserve extended a helping hand to the rates of the debt market and the US dollar. Precious metals reacts sensitively to the behavior of these assets: the strengthening of the US currency makes imports in the largest consumer countries of the physical asset more expensive. At the same time, non-yielding gold is not able to adequately compete with treasury bonds in the event of an increase in yield.

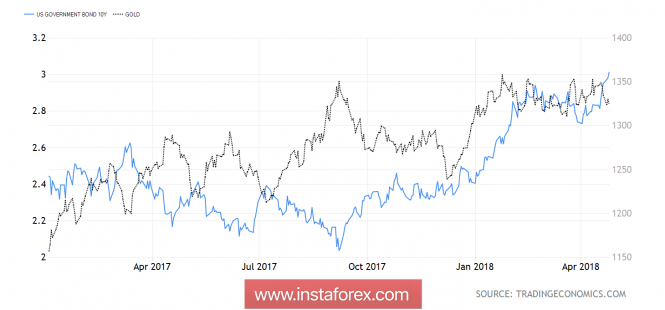

Dynamics of the yield of US and gold bonds

The growth of rates in the 10-year American debts above the psychologically important level of 3% to the maximum level since the beginning of 2014 has become a real catastrophe for the "bulls" of XAU/USD. Moreover, increasing the attractiveness of bonds leads to the diversification of investment portfolios in their favor, so the cost of servicing ETF products is even more expensive. But in April, according to Commerzbank, the reserves of specialized funds increased by 53 tons, which is equivalent to all inflows for the first quarter. Uncertainty about the US-China trade conflict, geopolitical problems in the Middle East and the reluctance of the US dollar to strengthen in response to the Fed's "hawkish" rhetoric have inflated the demand for these assets, but at the end of April the external background has radically changed. This can lead to loss of the ETF.

In general, it seems that 2015-2016 has returned, when rumors about the normalization of the monetary policy of the Fed pushed up the USD index. In April, the chances of four federal funds rate increases in 2018 increased from less than 30% to almost 50%, which is one of the main drivers of growth in Treasury yields. The second is the increase in inflation expectations under the influence of the Brent rally to $75 per barrel.

Not the least role in the correction of the USD index is the weakness of the euro on the eve of the meeting of the Governing Council. The ECB is concerned about the impact of the revaluation of the single European currency and trade conflicts on the eurozone economy. The latter lost steam in the first quarter, however, its gradual recovery during the rest of the year will return to the market rumors about the normalization of the ECB monetary policy and will help restore the EUR/USD position. Gold will be able to benefit from this fact due to its high correlation with the US dollar.

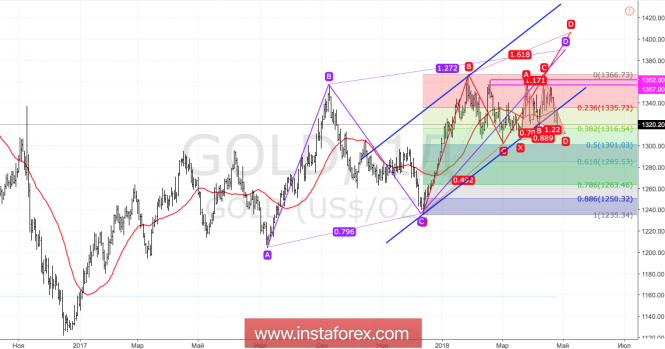

Technically there is a retest of the lower border of the upward trading channel. If the "bulls" manage to return gold quotes into it and consolidate above the resistance at $1336 per ounce, the risks of recovery of the upward trend will increase. On the contrary, if the buyers do not succeed, the peak of the precious metal in the direction of targeting by 88.6% in the pattern of the "Shark" is likely to continue.

Gold, daily chart

No comments:

Post a Comment