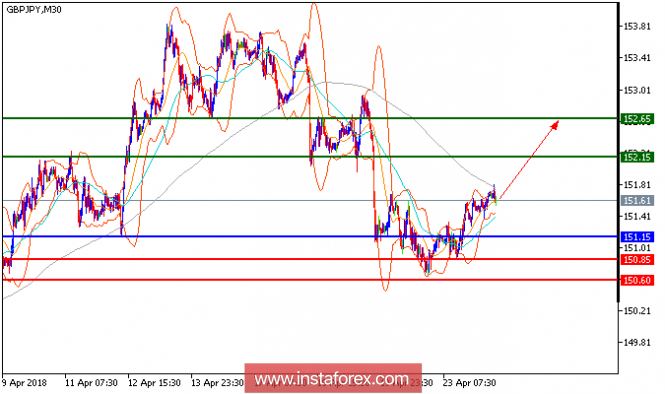

GBP/JPY is expected to trade with a bullish outlook. The pair is heading upward now, backed by its ascending 20-period and 50-period moving averages. The process of higher highs and lows remains intact, which should confirm a bullish outlook. Furthermore, the relative strength index is also positive, and calls for further advance. In which case, as long as 151.15 is not broken, it's likely advance to 152.15 and 152.65 in extension.

Fundamentally:

The British pound saw its loss widened at levels below the $1.4000 level as investors started to doubt if the Bank of England would raise interest rates in May considering weaker-than-expected economic data.

Chart Explanation: The black line shows the pivot point. Currently, the price is above the pivot point which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines show the support levels, while the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 152.15, 152.65, and 152.65

Support levels: 150.85, 150.60, and 150.

The material has been provided by InstaForex Company - www.instaforex.com

No comments:

Post a Comment